ON WHY WE’RE DOING THIS

To nurture, grow the Zebras, keep their mission and bridge them to the funding ecosystem in the emerging market.

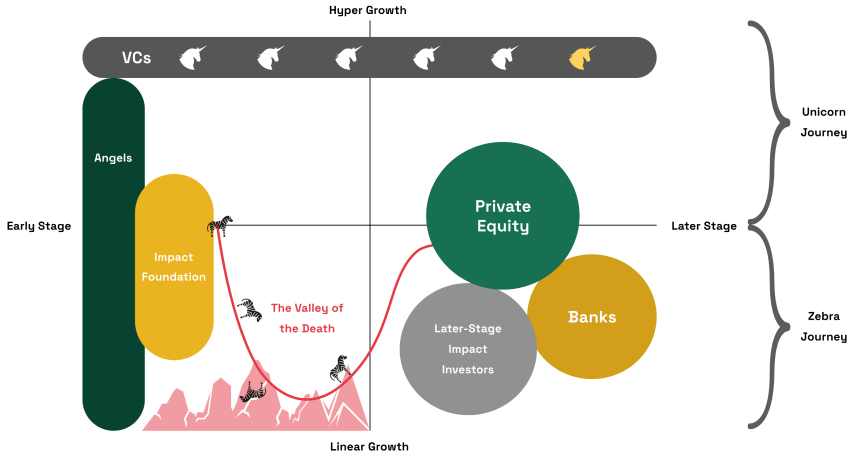

This is how we see the current situation of existing funding instruments.

This is how we see the current situation of existing funding instruments.

At this gap, the available fundings are not suitable for Zebra’s business model, adding some challenges such as:

1

A toxic valuation game, unsustainable hyper growth expectation

2

Systemic & inevitable fundraising cycle

3

Mission drift risk from equity dilution

4

High interest rates for unsecured debt up to 25%+

5

Not enough historical track record to access conventional debt

At this gap, the available fundings are not suitable for Zebra’s business model, adding some challenges such as:

1

A toxic valuation game, unsustainable hyper growth expectation

2

Systemic & inevitable fundraising cycle

3

Mission drift risk from equity dilution

4

High interest rates for unsecured debt up to 25%+

5

Not enough historical track record to access conventional debt

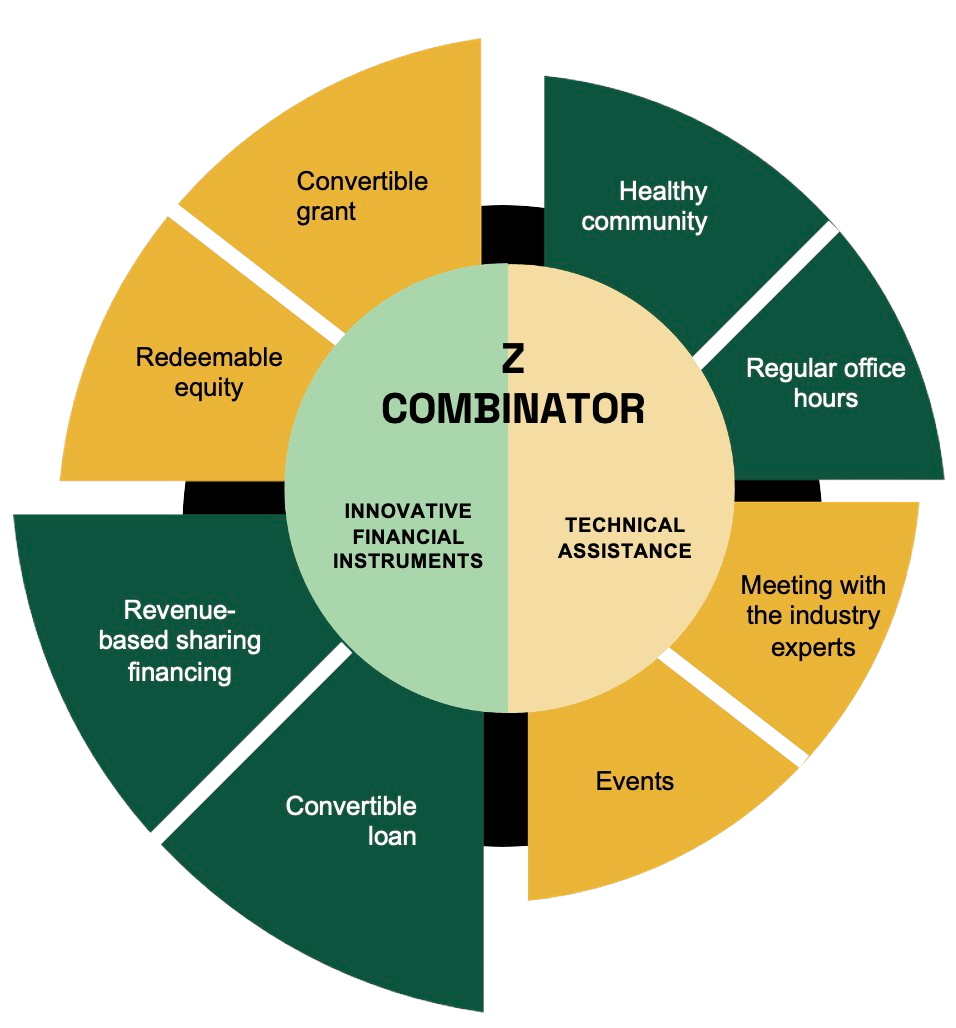

HOW WE DO IT

Hence, we create a bridge for these zebras to grow healthily until they are ready to receive investment from the later stage investors.

FOCUS AREA

Our investment thesis is prosperous people and planet.

Because Human and Earth are interconnected.

We will make sure to keep the impact measured and intact through an Integrated Impact Framework for sustainability.

Because Human and Earth are interconnected.

We will make sure to keep the impact measured and intact through an Integrated Impact Framework for sustainability.

NATURE BASED SOLUTION

In sectors such as agriculture, fisheries & aquaculture. Regenerative, sustainable & responsible farming, climate smart agriculture, technology-related.

CLIMATE & ENVIRONMENTAL SOLUTION

Carbon issues, energy transition, waste reduction, circular economy and sustainable resource use.

WHO WE’RE LOOKING FOR

We are looking for companies or Zebras who are in Seed and Pre-Series A investment stage equivalent.

| Maturity Level | Milestone | Investment Stage Equivalent |

|---|---|---|

Baby

Baby

|

Prototype | Bootstrapping |

Toddler

Toddler

|

Product-Market Fit | Angel |

Teenager

Teenager

|

Revenue Generator | Seed |

Young Adult

Young Adult

|

Scaling Stage | Pre-Series A |

Adult

Adult

|

Sustainable Growth | Series A |

| Maturity Level |

Baby

Baby

|

Toddler

Toddler

|

Teenager

Teenager

|

Young Adult

Young Adult

|

Adult

Adult

|

||||

|---|---|---|---|---|---|---|---|---|---|

| Milestone | Prototype | Product-Market Fit | Revenue Generator | Scaling Stage | Sustainable Growth | ||||

| Investment Stage Equivalent | Bootstrapping | Angel | Seed | Pre-Series A | Series A |

WE ARE PART OF

INVESTMENT PORTFOLIO

WE ARE HERE TO HELP

Get to know our team and how we can partner with you.